From Displacement to Dignity: How Financial Inclusion is Empowering Venezuelan Migrants in Colombia

Sighting the example of the Venezuelan refugee influx in Colombia, Isidro shares how financial inclusion initiatives help rebuild the lives of migrant populations; empowering them—especially women—with tools to achieve stability, foster belonging, and contribute meaningfully towards their new communities.

When everything falls apart, where do you start again?

Forced to leave behind homes, jobs and loved ones, millions of Venezuelan families like Yulimar, a mother of two, crossed into Colombia with little more than hope in their pockets. Since 2015, due to rampant crime, hyper-inflation, food shortages and essential services, there has been a significant influx of Venezuelans seeking refuge in Colombia. This country, which now hosts the third-largest number of refugees in the world, is experiencing the worst forced displacement crisis ever in Latin America. Being a transit country for displaced people, it has nearly 3 million Venezuelans seeking safety within its borders.

The majority of Venezuelans face another challenge in their host countries across the region. Due to the lack of documentation to stay regularly in them, they find it a challenge to access basic services and formal employment.

To address forced displacement across the country, World Vision Colombia made a bold commitment at the Global Refugee Forum (GRF): to promote the financial inclusion of Venezuelans seeking to rebuild their lives in Colombian communities. At the heart of this pledge was a simple but powerful idea— Venezuelans who are financially empowered are more likely to achieve long-term stability and contribute positively to the societies that host them. The contextualised solutions-based approach empowers them with tools to manage their money, start businesses and plan for the future. Today, several years into the initiative, the results tell a story of resilience, community building, social cohesion and the transformative power of access to finance.

Small beginnings, big changes

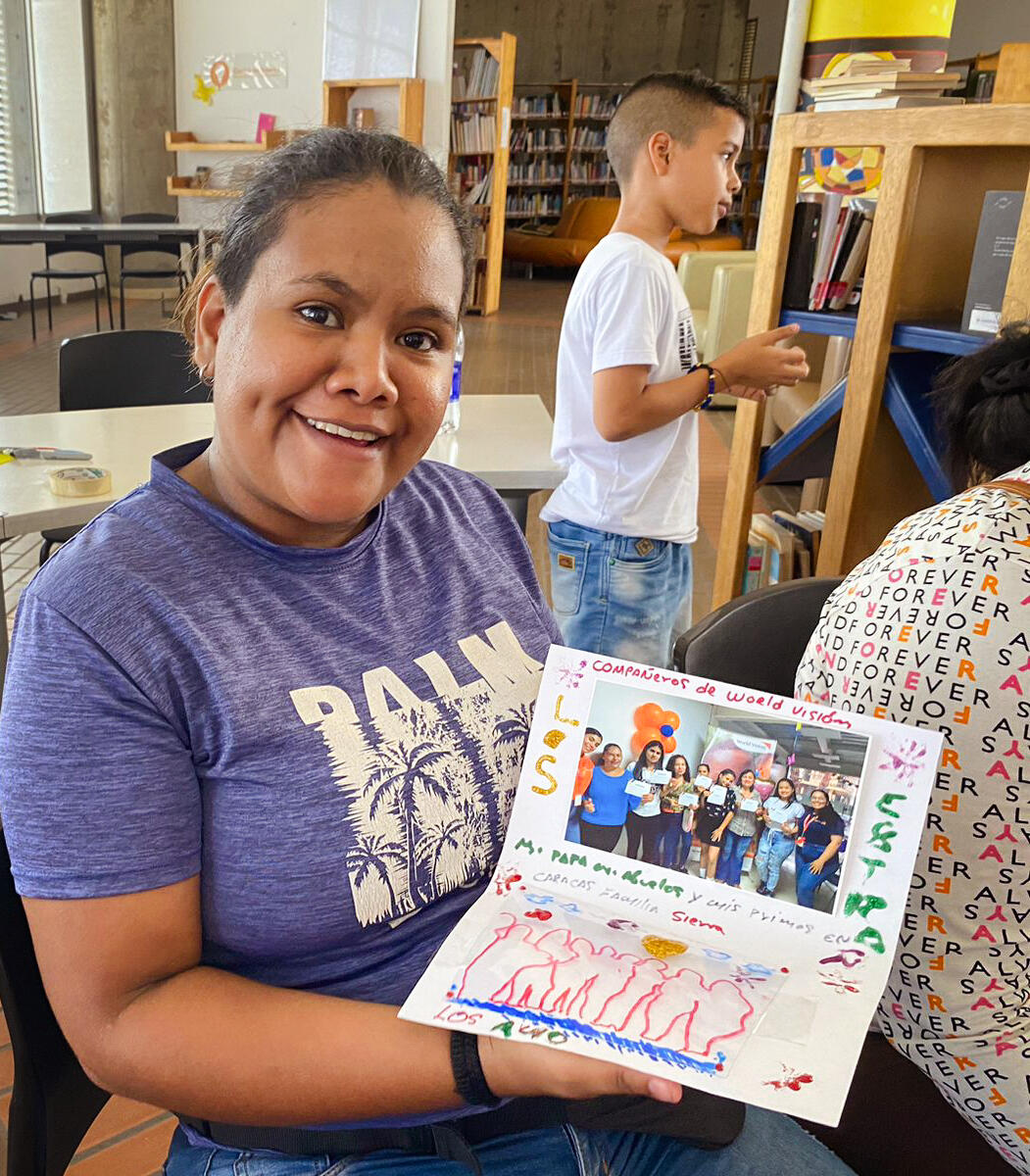

Yulimar arrived at Cartagena with nothing but a suitcase and dreams of a better future. She joined one of the community savings groups, set up by World Vision, a simple concept where neighbours pool their money, support one another, and access small loans. With her first loan, Yulimar bought a second-hand hairdryer and opened a modest beauty salon in her neighbourhood. A year later, her business not only supported her family, but it also provided work to other young mothers.

The pledge catalysed a structured and community-based approach to financial inclusion. More than 1,100 people, most of them women, have received financial education and support in cities like Cali and Cartagena. Another 2,000 people, including children, have benefited through stronger family income and stability. These programmes have been critical in helping Venezuelan migrants and refugees, as well as vulnerable people in host communities, understand basic financial principles.

Crucially, this progress was made possible because of the humanitarian assistance provided at the onset of displacement. Upon arrival in Colombia, migrants received cash assistance for a few months that helped them meet their basic needs. This initial support created the stability necessary for them to begin engaging in more sustainable economic activities. Only after their most pressing needs were met were they able to join savings groups and pursue entrepreneurial ventures.

Over 260 Venezuelans joined savings groups, and dozens of budding entrepreneurs received seed capital to launch businesses, from food stalls and tailoring services to beauty salons and mobile shops. This progression illustrates the critical link between emergency aid and sustainable solutions for the long-term through financial inclusion.

More Than Just Money

Financial inclusion is about giving people back the power to decide their future. People participating in the programme increased income, improved access to essential services and greater financial autonomy. Many have used their loans to set up microenterprises—from nail salons to food stalls—that now support their families and even employ others.

The real success of the programme isn’t just in pesos. It’s in the joy of someone making their first sale. The pride in saving for a child’s school uniform. The comfort of knowing you’re not alone. Such programmes, have renewed the confidence of the migrants, reduced their stress, and given them hope for the future.

It helps create a sense of belonging and they no longer feel outsiders but valuable members of the community. These savings groups have become circles of trust, friendship and healing. In a new country where everything feels uncertain, that sense of community makes all the difference.

The cash transfer support embedded in the savings group model has proven to be vital in combating the isolation that migrants feel upon arrival. This sense of belonging and mutual trust is key to long-term integration.

What we’ve learned

Along the way, there are some lessons learned. Firstly, provide cash transfers for life-saving assistance to migrants. This helps them access financial services and improve their digital and financial literacy.

Secondly, start with savings groups that create trust and are entry points for migrants and vulnerable Colombians alike. Thirdly, keep it simple. Our financial training should be practical, and easy to follow.

Fourthly, build on strengths. Many participants already possessed experience and skills. Craft businesses are rooted in their own strengths. Lastly, invest in women. With more than 80% of participants being female, this initiative is a powerful tool for empowering women.

Barriers still stand

Even though Colombia has made legal efforts to open doors for migrants, many are still turned away by banks. Such roadblocks keep families from accessing the services they need. While some have found success through self-employment, formal jobs remain out of reach for most. Only 4% of our participants found stable work. More jobs and more support from employers and local governments are necessary.

What needs to happen next

To move from pilot to scale, stronger collaboration is essential. To ensure migrants have access to basic services and can stand on their own feet, all actors have a role to play. Governments ensure that protection policies are not just written but followed at the local level. Banks must update systems and train staff, so migrants can access the services they’re entitled to. UN and donors replicate this model in other countries. NGOs keep listening, adapting, and advocating for those left out.

A model of resilience for Latin America

The simple truth: people don’t want handouts; they want a chance. That’s what financial inclusion means. It’s not just banking. It’s rebuilding lives with dignity, step by step.

As we look to expand this model across Latin America, the lessons from Colombia are clear: resilience is not built through charity, but through inclusion. When migrants are seen not just as recipients of aid but as agents of change, entire communities thrive. The pledge of World Vision to promote the financial inclusion of migrants in Colombian communities, is more than a policy. It is a lifeline for families. With continued support, innovation, and accountability, this vision can become a reality.

Isidro Navarro is the Senior Technical Advisor, cash transfers & market-based programming. Throughout his 30 years of experience in the humanitarian sector, he has gained considerable experience in cash transfer programme design and implementation, supporting the development of project proposals for main institutional donors, not only in preparedness, anticipatory action and emergency responses but also linking relief to recovery and long-term development.